20+ Borrow 100k mortgage

A prime borrower in a lenders eyes would have a credit score above 720 a debt-to-income ratio below 36 and a down payment of 20 to accompany their 100000 salary. Current 20-year mortgage rates.

Should I Buy A Home With Cash Or A Loan Quora

A downpayment less than 20 often requires that the borrower purchase PMI.

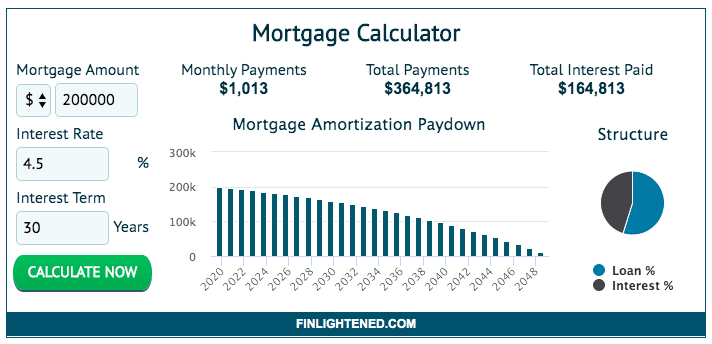

. It can be used for a car loan mortgage student debt boat motorcycle credit cards etc. For a 30-year fixed mortgage with a 35 interest rate you. Before applying for a mortgage you can use our calculator above.

This provides a ballpark estimate of the required minimum income to afford a home. This can be used for any loan such as a 100k car loan RV motorcycle credit card debt student loan etc. Monthly payments on a 100000 mortgage.

100000 dollars over 10 years at 25 using biweekly payment frequency period. Want to know exactly how much you can safely borrow from your mortgage lender. For this non-security loan for 100k the numbers below represent the lenders demands on the cost of borrowing.

This is the amount you borrow. Use this calculator to calculate the monthly payment of a loan. This will allow you.

The average 20-year refinance APR is 6150. Just fill in the interest rate and the payment will be calculated automatically. Please note these rates are for illustrative purposes only and you should not rely on these rates but get a professional financial quote for your 100000.

So you really want to find that sweet spot between an appropriate term length and a decent interest rate. This is because lenders are not concerned with how you are using the funds but rather how you will be repaying. On Saturday September 10 2022 the national average 20-year fixed mortgage APR is 6150.

Most loans of 100K do not have a restriction on their use. To understand how this works. Assuming you have a 20 down payment 24000 your total mortgage on a 120000 home would be 96000.

This increases the overall monthly payment. Assuming you have a 20 down payment 20000 your total mortgage on a 100000 home would be 80000. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 47742 a month while a 15.

Loan Payment Table for a 100000 Mortgage by Interest Rate. The Maximum Mortgage Calculator is most useful if you. For a 30-year fixed mortgage with a 35 interest rate you would be looking.

This calculates the monthly payment of a 100k mortgage based on the amount. Each mortgage payment reduces the principal you. 10 Year 100000 Mortgage Loan.

Are assessing your financial stability ahead of.

3

What Are The Mortgage Loan Interest Rates Quora

Piti The Cost Of Owning A Home

Where Can I Get A 20 Thousand Instant Loan Quora

:max_bytes(150000):strip_icc()/shutterstock_532025803.mortgage.insurance.cropped-5bfc314046e0fb00265cf926.jpg)

6 Reasons To Avoid Private Mortgage Insurance

No Doc Home Loans Borrow With No Proof Of Income

Getting A Mortgage While On Income Based Repayment Ibr

1

1

Getting A Mortgage While On Income Based Repayment Ibr

Struggling To Pay Off Mortgage Faster Any Reason To R Personalfinance

Game Of Loans How To Get Rid Of Student Loans And Debt

6 Reasons The Rich Should Pay Off Their Mortgage Early

1

Request What Were The Terms Of This Loan R Theydidthemath

Which Formula Dictates That You Pay More Interest At The Beginning Of The Loan Quora

/shutterstock_250676278.housing.market.real.estate.crash.mortgage.cropped-5bfc315b4cedfd0026c226cd.jpg)

Mortgage Payment Structure Explained With Example